COMPANY NEWS

Share Purchase Plan Offer Booklet

Invitation to Participate in Share Purchase Plan

2025 Appendix 4G and Corporate Governance Statement

2025 Financial Statements

Date of 2025 Annual General Meeting

INDUSTRY NEWS

Blue Energy continues to add shine to Sapphire gas project

AEMO 2023 Electricity Statement of Opportunities

States hit for ‘demonising’ gas

North Bowen gas deals bolster case for ‘missing’ link

GOVERNMENT NEWS

Bowen Basin Pipeline Study – Phase 2 Complete

ACCC Gas Inquiry – Interim Report

Bowen Basin Pipeline Study – Final Report Released

Basin plan to crack the nut in central Queensland

About

Blue Energy is a rapidly evolving oil and gas exploration company strategically positioned with abundant conventional and unconventional assets throughout Queensland and the Northern Territory to meet the rising demand for cleaner energy.

Blue Energy has a vision to be Australia’s leading mid-sized oil and gas exploration and production company and to continue to build the 3P reserve base and grow a liquids portfolio from our frontier acreage.

The vision is underpinned by Government policy, as Australia move to a cleaner, more fuel efficient lower carbon economy.

Since listing on the ASX in June 2006, Blue Energy has worked hard to establish a solid operational foundation with an experienced board and technical team.

We believe our team's experience and skills have the ability to enable Blue Energy as one of the leaders in our industry.

Given the experience and knowledge base our team possess, it holds Blue Energy in high regard to effectively execute its exploration strategy.

Blue Energy’s exploration focus is to leverage from the attractive geology and location of its majority-owned and operated conventional and unconventional oil and gas assets.

Fast Facts

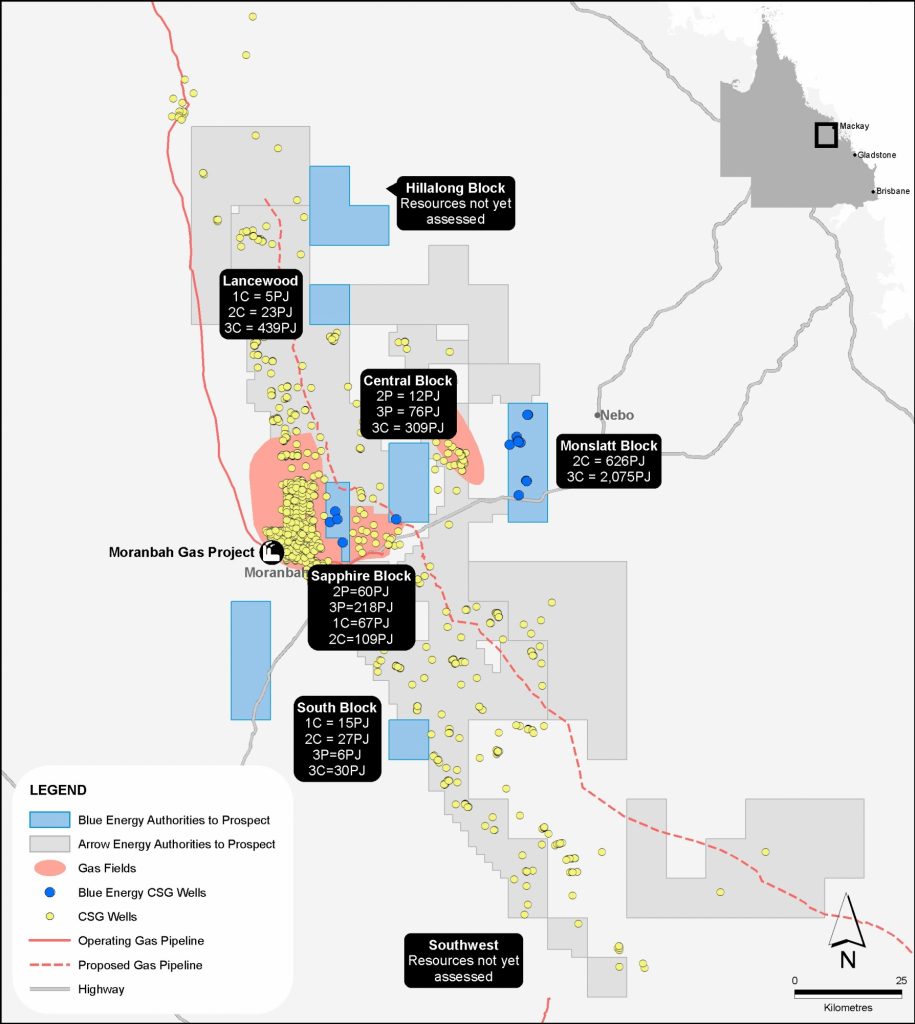

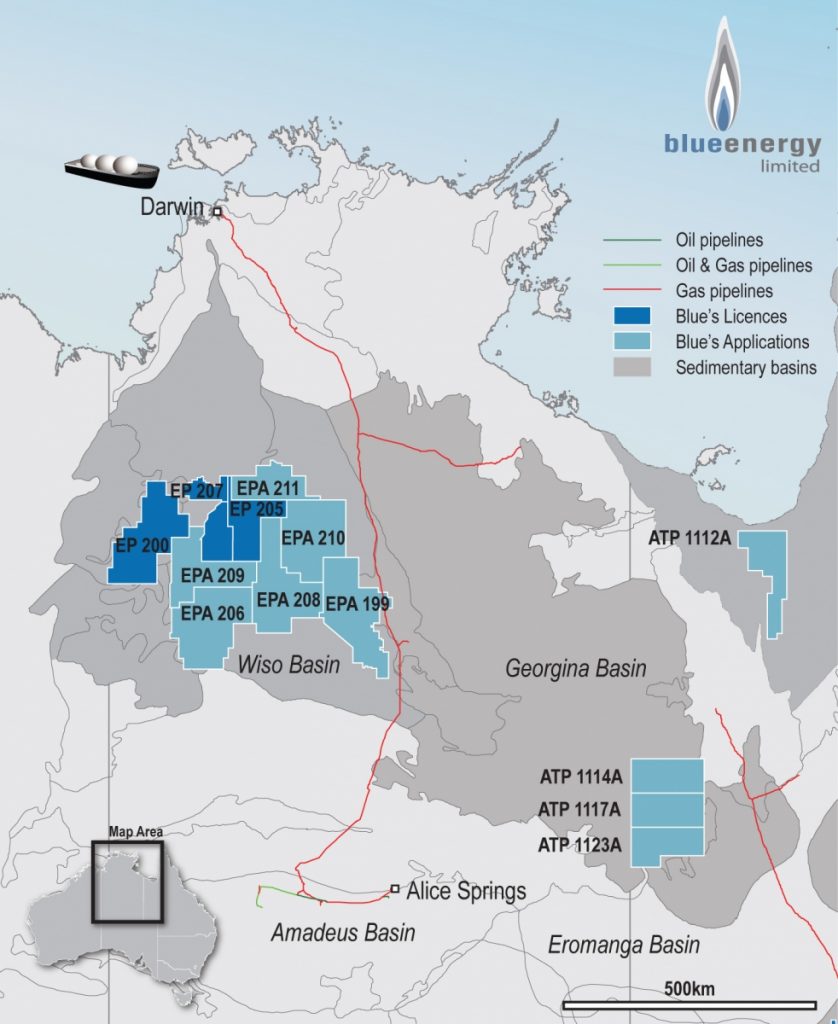

RESERVES

- 2P: 71 PJ

- 3P: 298 PJ

- 2P + 2C: 1,384 PJ

- 3P + 2C: 1,611 PJ

RESOURCE BASE

- 3C: 4,476 PJ

PROVEN BASINS

- Bowen

- Surat

EMERGING BASIN

- Greater McArthur

SIGNIFICANT ADJACENT TENEMENT HOLDERS

SIGNIFICANT SHAREHOLDERS

History

|

Netherland Sewell and Associates upgrade gas resource in Surat ATP 854 to 398 PJ 3C Contingent Resource (+300%) |

|

Blue executes (non binding) Heads of Agreement with Origin Energy to supply up to 300 PJ of domestic gas at Wallumbilla |

|

Blue executes (non binding)Heads of Agreement with EnergyAustralia to supply 100 PJ of domestic gas at Wallumbilla |

|

Netherland, Sewell and Associates issue resource upgrade in Hillalong Block of ATP 814 - 237 PJ 3C Contingent Resource |

|

Blue signs Heads of Agreement with Queensland Pacific Metals to supply of 112 PJ to Townsville |

|

Netherland, Sewell and Associates Inc issues reserves upgrade |

|

Blue secures 100% of Maryborough Basin permits. |

|

Blue Energy’s exploration portfolio expanded by 100% with Wiso Basin farm-in. |

|

Maiden 2P Reserves of 50PJ. |

|

New Maryborough Basin permits granted. |

|

Mr John Ellice-Flint appointed Chairman. |

|

New Shale Gas and Oil Permits double Blue Energy's exploration acreage portfolio. |

|

John Ellice-Flint joins Blue Energy and becomes substantial shareholder. |

|

Maiden 3P Reserves for ATP814P of 39PJ. |

|

Netherland, Sewell and Associates Inc. issues initial resource estimate. |

|

KOGAS takes 10% placement in Blue Energy. |

|

John Phillips joined the company as COO and was promoted to CEO as of April 2010. |

|

Stanwell acquired a 19.9% stake in the company from a former shareholder, executed Alliance Agreement to facilitate Gas Sale Agreement. |

|

ANZ Bank appointed Receiver to Primebroker Securities and took control of 113 million BUL shares under margin lending security. ANZ remain Blue Energy's largest shareholder. |

|

Energy Investments Ltd (EIV) invested in Blue Energy, changed it's name to Blue Energy and the listed entity as we know it today was established. |

|

Blue Energy commenced as a private petroleum exploration company with assets in several producing Australian Basins. |

Vision Mission Strategy

VISION

Blue Energy has a vision to become Australia’s leading mid-sized oil and gas exploration and production company and to continue to build the 3P reserve base to 3TCF.

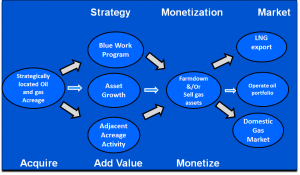

STRATEGY

Blue Energy will utilise our own work program to add value plus use adjacent competitor activity to enhance the value of Blue's portfolio wherever possible. In this way, Blue will minimise expenditure of our shareholders' funds, but maximise the benefit of competitor expenditure to Blue Energy.

COMMERCIAL OBJECTIVES

- Achieve commercial gas flow rates from its North Bowen Basin assets.

- Build Blue's 2P and 3P gas reserves and contingent gas resources base.

- Continue to undertake work on the Production Licence applications for the ATP 814 permit resource in the Bowen Basin.

- Add value to greenfield assets at the front end exploration phase

- Maintain excellent safety record

Blue Energy seeks to service both the domestic east coast gas market plus the LNG export market, where approriate.

Blue has executed Heads of Agreements (non- binding) with Origin Energy and EnergyAustralia for the supply of gas for their domestic operations, delivered to Wallumbilla, for 10 years, with total contracted volumes up to 400 PJ. These gas volumes are set to underpin a gas pipeline construction to link the North Bowen Basin with the east coast gas market at Wallumbilla. Blue has aslo executed an MoU with Queensland Pacific Metals for the supply of 112 PJ of gas over 15 years to their proposed Townsville Nickel Refinery.

These agreements account for approximately 500 PJ of Blue's aggregate 4,476 PJ of Contingent Gas Resource. The active area in Blue's portfolio is the North Bowen Basin (ATP 814P) and these contracts are set to be primarily met from gas in this permit. These current gas supply agreements leave approximately 3,000 PJ of Blue's Contingent Resource book, un-contracted, which could be used to supply the export market, given the strong demand for gas globally and the tight supply currently being experienced.

Blue's strong financial and asset positions allows the company to negotiate from a position of strength in times of tight gas supply and rising gas prices, both globally and on the east coast, and therefore maximise commercial and shareholder outcomes. Through good Corporate Governance principles, Blue Energy’s Board of Directors will concentrate on demonstrating our ability to commercialise our gas resources.

Directors Management

MR JOHN ELLICE-FLINT

BSC (HONS) HARVARD, AMP

Chairman, Executive Director

Mr John Ellice-Flint is an Australian-born businessman whose foresight and wide-ranging oil and gas industry credentials are recognised internationally. John has over 45 years of exploration, production, operations and commercial experience in the oil and gas industry and has held many senior positions with multinational exploration and production companies. John’s achievements in the oil and gas industry are well-known and highly respected.

Following a 26-year international career at Unocal Corporation, serving in a variety of senior executive roles within strategic planning, exploration and technology functions, John became Managing Director and CEO of Santos Limited, Australia’s largest domestic gas producer, from 2000 – 2008. John guided Santos Limited through a major growth period which culminated in the recognition of the potential of coal seam gas development through the Gladstone LNG export project in Queensland.

MR JOHN PHILLIPS

BSC (HONS), GAICD

Managing Director

John is a Petroleum Geologist with over 35 years of experience in the oil and gas industry. John joined Blue Energy as Chief Operating Officer in May 2009, was promoted to CEO in April 2010 and joined the Board of Blue Energy in June 2010. John’s career in industry has involved oil and gas experience in a variety of petroleum basins both domestically and internationally.

John has gained extensive operational experience through his involvement with Delhi Petroleum, Esso, Conoco, Petroz and Novus, culminating in his role as Chief Operating Officer with Sunshine Gas before its takeover by QGC and subsequently by the BG Group.

MR MARK HAYWARD

B. BUS(ACC), FCA, MAICD

Non-Executive Director

Mark is a Chartered Accountant and was a partner at Ernst & Young for 31 years until 30 June 2020 primarily in the financial audit group. He has extensive experience working both locally and internationally with companies in the energy and resources sectors including those with operations in Australia, Canada, USA, Singapore and South America.

Mark brings to the Board strong technical accounting skills and an ability to identify the key risk areas for the company and industry.

Mark chairs the Risk and Audit Committee.

Sustainability Heritage

HEALTH, SAFETY & ENVIRONMENT

Blue Energy is committed to providing a workplace that actively protects the health and safety of all personnel in every aspect of its business through the demonstrated safety leadership shown by Blue Energy Managers.

- Blue Energy recognises that environmental considerations and responsibilities are an integral part of our operations

- We are committed to complying with all regulatory standards

APPROVED UNDERGROUND WATER IMPACT REPORT FOR ATP 814P

Pursuant to the requirements of Chapter 3 (Sections 381, 382 and 386) of the Water Act 2000, Blue Energy Ltd. has developed an Underground Water Impact Report (UWIR) for its exploration operations within Authority to Prospect (ATP) 814P.

The UWIR for ATP 814P has been approved by the Department of Environment and Heritage Protection (EHP) and has a commencement date of 1 December 2012. Electronic copies (PDF) of the approved UWIR can be obtained by e-mail request to info@blueenergy.com.au or by phoning us at +61 7 3270 8800.

Community Ethics

OUR SOCIAL LICENCE TO OPERATE

Blue Energy interacts and engages with stakeholders in many towns and communities as part of the Company’s activities on exploration tenements across Queensland and the Northern Territory.

We are proud of our record and ongoing commitment to earn the respect of the various communities with which we are involved.

This approach has achieved extensive community and stakeholder support for, and approval of, our operations and of the way we conduct ourselves as guests in those communities.

At the same time, we are mindful that groups such as landholders, business owners, service providers, traditional owners, community groups, and other organisations, may be affected in some way by the work undertaken by Blue Energy.

With both primary industries and the energy sector being so vital to our everyday lives, it is therefore important that we continue to support community interest and involvement in all issues relating to our important energy sector.

STAKEHOLDERS

Blue Energy’s goal continues to be the building of effective and positive relationships in each of the locations in which we operate and to ensure our operations benefit local communities. Relationship-building is an ongoing process, and we are dedicated to fairly and effectively managing our stakeholder consultations, negotiations, and land access. Our relationships are built on:

- transparent and open communications;

- mutual respect; and

- establishment and maintenance of relationships meeting, and where possible, exceeding expectations.

Understandably, landowners and others will continue to have questions and we take every opportunity to discuss all of the issues and to provide factual information about petroleum exploration.

We also view our role as working with stakeholders in areas such as planning work programs with consideration for landowner businesses and reaching agreement on operational aspects of our business that minimises our impact on the landowners’ activities. We have found most landowners receptive to our approaches.

Finally, we respect the rights of any who may not wish to pursue discussions regarding petroleum exploration activities.

COMMUNITY SUPPORT

We believe the exploration activities conducted by Blue Energy will bring economic growth and opportunities to local communities, including providing direct support to local organisations and events.

Our community sponsorships have includes:

- Ballyneety Rodeo Club

- Aramac Rodeo Club Inc

- Summer Family Appeal

- NeboQuick Shear

- Aramac school

- Nebo Bushmans carnival Inc

- Flock and Ewe show

- Maryborough Hospital

- Muttaburra school

EXPLORATION, DEVELOPMENT & PRODUCTION

While industry media coverage centres on the activity surrounding Queensland’s major, high profile LNG export projects, these projects do not represent the exploration activities undertaken by Blue Energy.

Exploration is finding a petroleum opportunity, drilling the opportunity and if successful appraising it to determine commerciality. This process is essentially similar for both conventional and unconventional hydrocarbons. Such activities can be as minimal as conducting desktop studies which can lead to drilling of stand-alone core holes or exploration wells and with success, to multiple pilot appraisal wells that are production tested for up to 12 months. Alternatively, conventional oil and gas exploration wells can be tested then additional appraisal wells drilled to confirm the extent of any hydrocarbon accumulation.

Compared to development and production activities, exploration is low in intensity (well numbers) and uncertain in outcome (it may fail or might succeed). In fact, petroleum exploration activities have been ongoing in many areas of Queensland for decades and have commonly gone unnoticed because of the relatively small impact.

THE ENVIRONMENT

Blue Energy understands and fully endorses the need to protect valuable aquifers. Fortunately, CSG does not come from prolific or high quality conventional aquifer sands, such as key sandstone aquifers of the Great Artesian Basin.

To produce CSG, the target coals need to have very limited connectivity to aquifer formations; otherwise, only water would be produced with no gas. A report from Geoscience Australia to the Australian Government recommends a precautionary approach but concludes the risk of impact from CSG production is minimal to the clean aquifers of the Great Artesian Basin. This point is being confirmed by more and more scientifically robust studies which highlight specific and localised areas of impact and concern, and which will be the focus for monitoring and mitigation of impacts.

The petroleum industry is heavily regulated, and has been for many decades. In Queensland, the Petroleum and Gas Act underwent a major regulatory update in 2004. Each year since then, more regulations have been installed and continue to be added. For each of Blue Energy’s exploration tenements, we operate under an Environmental Authority that can have more than 100 conditions specific to the area of the permit. At present, the current number of regulations and conditions are estimated to total around 2,500 for exploration activities.

Corporate Governance Policies

BLUE ENERGY ANNUAL CORPORATE GOVERNANCE STATEMENT

The ASX Corporate Governance Council has published Corporate Governance Principles and Recommendations (most recently amended on 1 July 2014) which specify the following material that should be made publicly available on an ASX Listed Entity’s public website. The Board has adopted the revised Corporate Governance Principles and Recommendations 3rd Edition, subject to the exceptions noted in the more detailed corporate governance statement found in the policy links below.

Principle 1 - Lay Solid Foundations For Management and Oversight

(Guide to Reporting on Principal 1, Recommendation 1.3)

The Board Charter, sets out the matters reserved for the Board and those matters delegated to various committees and to senior executives.

Principle 2 – Structure The Board To Add Value

(Guide to Reporting on Principal 2, Recommendation 2.6)

Blue Energy does not have a dedicated Nomination Committee but rather the task of developing and implementing policies and procedures for nomination, selection and appointment of new directors as well as the re-election of incumbent directors is dealt with by the full board.

Principle 3 – Act Ethically and Responsibly

(Guide to Reporting on Principal 3, Recommendation 3.3)

Code of Conduct

Blue Energy has established an organisational code of conduct having regard to the Australian Standard 8002-2003 and to the suggestions set out in the ASX Corporate Governance Principles and Recommendations – Recommendation 3.1. Our Code of Conduct sets out our key corporate values, our commitment to compliance with laws and regulations, behavioural standards that are expected from our people and our commitment to act with honestly and integrity in our business dealings and in our dealings with the general community. Individuals have a positive obligation to report unethical behaviour and the Company has established procedures for investigating such reports.

Blue Energy has established a Diversity Policy, having regard to the suggestions set out in the new ASX Corporate Governance Principles and Recommendations. Our diversity policy covers gender, age, ethnicity and cultural background. Due to the size and nature of Blue Energy’s operations the board has not established measurable objectives for achieving gender diversity, but rather has adopted a range of internal policies and procedures such as a nomination process for directors, and a recruitment and selection process for staff, all of which are designed to promote diversity.

Principle 4 – Safeguard Integrity In Financial Reporting

(Guide to Reporting on Principal 4, Recommendation 4.4)

The Risk and Audit Committee Charter, sets out the procedures for the selection and appointment of external auditors, and for the rotation of external audit engagement partners

Principle 5 – Make Timely And Balanced Disclosure

(Guide to Reporting on Principal 5, Recommendation 5.2) Blue Energy has established a compliance program based upon the principles set out in the Australian Compliance Standard AS 3806:2006 which is designed to ensure compliance with a range of legal, regulatory and corporate governance obligations including the disclosure requirements set out in the ASX Listing Rule and the ASX Corporate Governance Principles and Recommendations. Blue Energy monitors compliance with these obligations through our on-line governance, risk and compliance software system CompliSpace Assurance.

Our key disclosure policies are:

Continuous Disclosure

Blue Energy has established a Continuous Disclosure Policy, having regard to the suggestions set out in the ASX Corporate Governance Principles and Recommendations and in ASX Guidance Note 8 – “Continuous Disclosure – Listing Rule 3.1”. Our continuous disclosure policy details our legal obligations with regard to continuous disclosure and establishes materiality guidelines designed to assist the board in its decision making process. Blue Energy has appointed a continuous disclosure manager who is responsible for ensuring that the specific processes and procedures outlined in our continuous disclosure policy are implemented properly.

Periodic Disclosure

Blue Energy has established a disclosure policy that details our legal obligations with respect to periodic disclosure such as half year and full year reporting. All periodic disclosure obligations are identified and allocated to individuals who are responsible for completion of these tasks. These tasks are then monitored through our compliance program.

Securities Trading Blue Energy has established a Securities Trading Policy, that complies with ASX Listing Rules 12.9 - 12.12 and has regard to ASX Guidance Note 27 – “Trading Policies”. Our securities trading policy establishes closed periods between the end of the financial year and half year and the release of our financial results for these periods. All employees are restricted from trading in the company’s securities during closed periods unless they have obtained written authority to trade.

Such authority will only be provided in the event of severe financial hardship or the fact that a person’s circumstances are otherwise exceptional and that the proposed sale or disposal of the relevant securities is the only reasonable course of action available. Directors, officers and certain other employees, who may be privy to inside information, (“restricted persons”) have additional restrictions placed upon them and must not trade in the company’s securities at any time during the year without first obtaining written authority to do so. All employees receive training with respect to insider trading prohibitions and the requirements of our securities trading policy.

Principle 6 – Respect The Rights Of Shareholders

(Guide to Reporting on Principal 6, Recommendation 6.2)

It is Blue Energy’s desire to empower our shareholders by communicating with them effectively, giving them access to balanced and understandable information about the company, and making it easy for them to participate in general meetings. A copy of Blue Energy’s Shareholder Communication Policy is. It is designed to promote effective communication with shareholders

Principle 7 – Recognised and Manage Risk

(Guide to Reporting on Principal 7, Recommendation 7.4)

Blue Energy has established and documented an enterprise risk management program for the oversight and management of the company’s material business risks. This enterprise risk management program is based on the International Risk Standard AS/NZS ISO 31000:2009 and is complemented by our internal control program based upon the principles set out in the Australian Compliance Standard AS 3806:2006.

Blue Energy has fully documented a common risk language through which it considers internal risks such as those arising from areas such as financial and human resource management, and external risks such as those raising from dealings with key stakeholders and macro environmental issues such as a natural disaster or economic events beyond our control.

In assessing our material business risks, each identified risk is individually assessed in terms of the likelihood of the risk event occurring and the potential consequences in the event that the risk event was to occur. The company’s on-line governance, risk and compliance software system CompliSpace Assurance allows material business risks to be linked to mitigating controls so that the performance of the Company’s enterprise risk and compliance programs can be monitored continuously.

Principle 8 – Remuneration Fairly And Responsibly

(Guide to Reporting on Principal 8, Recommendation 8.1)

Blue Energy does not have a dedicated Remuneration Committee but rather the task of ensuring that the level of director and executive remuneration is sufficient and reasonable and that its relationship to performance is clear is dealt with by the full board.

Blue Energy Constitution

Blue Energy Employee Incentive Plan

Employee Incentive Rights Plan 2020

Blue Energy Policies

Corporate Governance Statement - Effective 15th September 2020

Risk and Audit Committee Charter

Shareholder Communications Policy

Values

Blue Energy is striving to leverage its large natural gas assets and return value to shareholders while helping bridge Australia’s energy transition gap through natural gas as part of the path to a Net Zero future.

In our endeavours to deliver this vison, we manage our operations and business and make our decisions in line with the following values:

- To prioritise safety, health, the environment, and the communities in which we operate.

- To ensure that employees and contractors feel free to speak up about genuine concerns and to protect those that do;

- To act with integrity, honesty and always within ‘the rule of law’ whilst remaining true to the Company’s values and accountable for its decisions and actions.

- To respect and treat fairly employees, contractors and stakeholder’s;

- To look for ways to improve how we carry out our operations and business activities through innovation and technology; and

- To create value for the Company’s shareholders and investors.

Investors

Blue Energy Limited's Share Registry is

managed by Computer Share investor services.

If you have any questions relating

to your shareholding,

you can contact the share registry by:

Fast

Facts.

Shares on Issue 1,140,993,237

Acreage 153,598km2

Reserves

2P 55PJ

3P 200PJ

3P + 2C 1,011PJ

Resource Base (3C) 3,454PJ

Company

Profile.

The Company has a vision to be Australia’s leading mid-sized oil and gas exploration and production company and to continue to build the 3P reserve base to 3TCF and grow a liquids portfolio from our frontier acreage.

FAQ's.

This page is currently being updated.

Investor Fast Facts

- Acreage (net):89235.5km2 / 22.1 million acres

- Operator of all acreage held

- Uncontracted gas reserves and resources

- Adjacent to major LNG proponents

- Diversity of basins

- Reserves:

- 2P 71PJ

- 3P 298PJ

- P + 2C 1,611PJ

- Resource Base (3C) 4,476PJ

SIGNIFICANT ADJACENT TENEMENT HOLDERS

- Arrow Energy

- Kogas

- Petro China

- Petronas

- Santos GLNG

- Shell

- Total

PROVEN BASINS

- Bowen

- Surat

SIGNIFICANT SHAREHOLDERS

- JEACH PTY LTD

- NETWEALTH INVESTMENTS LIMITED

- GIRDIS SUPERANNUATION PTY LTD

- HORRIE PTY LTD

- GEOTECH RESOURCES PTY LTD

- ROSSDALE SUPERANNUATION PTY LTD

- NGA PROMOTIONS PTY LTDA

- CITICORP NOMINEES PTY LIMITED

EMERGING BASINS

- Wiso

- South Georgina

Company Profile

BLUE ENERGY IS AN AUSTRALIAN OIL AND GAS EXPLORATION COMPANY, WITH ABUNDANT ASSETS IN PROVEN AND EMERGING FRONTIERS, THROUGHOUT QUEENSLAND AND THE NORTHERN TERRITORY.

WITH A FOCUS ON ATTAINING QUALITY BASIN POSITIONS, BLUE HAS THE VISION TO BE AUSTRALIA’S LEADING MID-SIZED OIL AND GAS EXPLORATION COMPANY.

PRIME BASINS

QUALITY POSITIONING

DOMINANT HOLDINGS

EMERGING OIL PROVINCES - FRONTIER BASINS

POSITIONED FOR EAST COAST AND EXPORT LNG GROWTH

2013 ACHIEVEMENTS

- Doubled acreage position to 110,000km2 (27.4 millions acres) net to Blue

- Re-aligned strategy to conserve cash while adding shareholder value

- Continued gas flow from Sapphire Block

- Maiden 2P reserves of 50PJ

- 6 years LTI free

- Increased 3P reserves by 150% to 187PJ

- Increased contingent resouce by 23% to 3,516PJ

- Strengthened relationships with Government and Landowners

- Reduced annual run rate by $2.7 million

- Zero environmental incidents

- Identified significant oil prospect in ATP854P

2014 GOALS

- Re-assess tenure priorities based on prospectivity

- Work program in ATP813P to expand contingent resource

- Conduct Native Title negotiations on outstanding permits

- Zero lost time injuries

- Zero environmental incidents

- Investigate further farmout opportunities

-

INVESTMENT CASE

Near Term Value Drivers

- Activity in frontier basins

- Gas shortage on East coast and North coast – domestic and LNG

- Uncontracted Gas Reserves on East Coast

Focussed Strategy - Gas and Oil

Strategic acreage position in hydrocarbon producing basins

Exposure to frontier liquids basins

Operatorship allows control

Continuous cost efficiency drive

For more information click here. -

Broker Reports

The following brokers have issued covered on BUL:

Wilson HTM - James Redfern +61 2 8247 6609

Ord Minnett - John Young +61 3 9608 4184

-

Top 20 Shareholders

Top 5 shareholders:

- JEACH PTY LTD

GIRDIS SUPERANNUATION PTY LTD

NETWEALTH INVESTMENTS LIMITED

HORRIE PTY LTD

GEOTECH RESOURCES PTY LTD

-

Capital Structure

Top 5 shareholders:

- Ordinary Shares

- 1,528,214,889

Financial Performances.

Cash Balance as at 31 March 2023 - $2.5m

Resources

Reserves.

Our Current Reserves and Resources:

2P 71PJ

3P 298PJ

3C 4,179PJ

For full details of our Reserves and Resources click here.

Industry News.

For an update on competitor activity and industry news click here.

Financial Performance

Resources Reserves

RESERVES AND RESOURCES

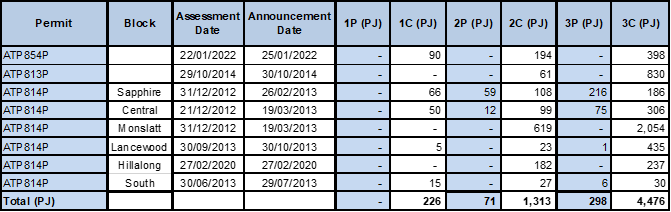

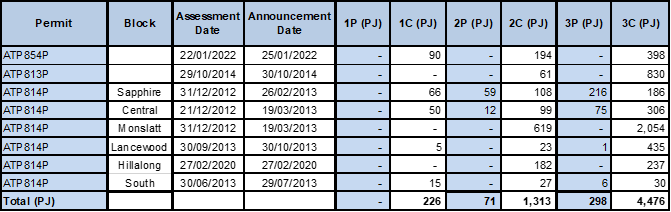

Blue contracts Netherland, Sewell and Associates of DallasTexas (NSAI) as an independent reserve and resource certifier to review all Blue energy's tenements. NSAI is a global tier 1 certifier in the unconventional gas sector and is contracted by most of the large CSG to LNG producers in the Surat and Bowen Basin of Queensland as the preferred independent certifier. Blue achieved its maiden 2P gas reserves in early 2013 in its 100% owned and operated ATP 814P in the North Bowen Basin.

The curent estimate of ATP 814P gas reserves and resources stands at 71 PJ of 2P and 298 PJ of 3P with a furrther 3,248 PJ in the Contingent Resource category (3C).

The most recent assessment by NSAI for Blue was for its 100% owned ATP 854 tenement near Injune in Queensland. This review yielded a 300% increase in Contingent Resource to 398 PJ of Contingent Resource (3C)

Together with ATP 813 in the Galilee Basin, Blue's aggregate 3C Contingent Resource base now stands at 4,476 PJ of recoverable gas.

COMPETENT PERSON STATEMENT

The estimates of Reserves and Contingent Resources noted throughout this Quarterly Activities Report have been provided by Mr John Hattner of Netherland, Sewell and Associates Inc (NSAI) and were originally reported in the Company’s market announcements of 25 January 2012, 26 February 2013, 19 March 2013, 8 December 2015, 28 February 2019, February 2020 and January 2022. NSAI independently regularly reviews the Company’s Reserves and Contingent Resources. Mr Hattner is a full-time employee of NSAI, has over 30 years of industry experience and 20 years of experience in reserve estimation, is a licensed geologist and a member of the Society of Petroleum Engineers (SPE), and has consented to the use of the information presented herein. The estimates in the reports by Mr Hattner have been prepared in accordance with the definitions and guidelines set forth in the 2018 Petroleum and Resource Management System (PRMS) approved by the SPE, utilising a deterministic methodology.

Bowen Basin

- 71PJ 2P and 298PJ 3P Reserves

- 3,248 PJ of Contingent Gas Resource (3C)

- Adjacent to Arrow Energy's Moranbah Gas Project

- Planned pipeline to connect to Gladstone/Wallumbilla

| Area | 1,119km² |

| Holding | 100% and Operator |

| Targets | Permian CSG targets: Rangal, Fort Cooper C and Moranbah Coal Measures. |

| Work Completed | Blue Energy CSG wells within the area 300+ Arrow Energy CSG production and pilot wells |

| Infrastructure | Moranbah to Townsville gas pipeline; Proposed Moranbah to Wallumbilla/Gladstone pipeline |

RESERVES & RESOURCES

ATP814P consists of six disconnected blocks in the North Bowen Basin in an area ranging from south of Moranbah up to Newlands in the Northern Bowen Basin. This general area is one of the largest coal mining areas in Australia.

All of the prospective geological sequences occur variously within the blocks comprising ATP814P. There is established CSG production in the vicinity of ATP814P, most notably the Moranbah Gas Project, operated by Arrow Energy. Currently the Moranbah Gas Project supplies gas into the domestic market to Townsville and Moranbah for Ammonium Nitrate productuion, however the region surrounding ATP814P is operated by Arrow Energy (a Joint Venture consisting of Shell and Petrochina) which had aspirations to supply gas to the Gladstone LNG projects and consequently the area surrounding ATP814P is subject to high levels of drilling activity and infrastructure development. Arrow has received all government approvals for the gas development and export infrastructure from Moranbah to Gladstone but has yet to take Final Investment Decision for the project (both gas field development and pipeline construction).

Drilling undertaken by Blue Energy in the permit to date has focussed on the Sapphire Block (PL 1034) which is flanked by Arrow Energy’s Production Licences. Activity on the flanks of the Sapphire Block has conferred 2P (59PJ) and 3P (216PJ) reserves in the Sapphire Block by Netherland and Sewell and Associates (NSAI), who are the Dallas based certifier acting for both Blue Energy and Arrow Energy. Adjacent activity by other Operators in both the ATP814P South and Lancewood Blocks has also resulted in 3P Reserves and Contingent Resources being conferred to Blue Energy by NSAI. The total 2P and 3P reserves in ATP814P are 71PJ 2P and 298PJ 3P.

Blue has entered Heads of Agreements (non-binding) to supply gas tp Energy Australia (100PJ) and Origon Energy (up tp 300 PJ) over 10 years at Wallumbilla. Blue has also executed an MoU with Quensland Pacific Metals to supply 112 PJ of gas to Townsville over 15 years.

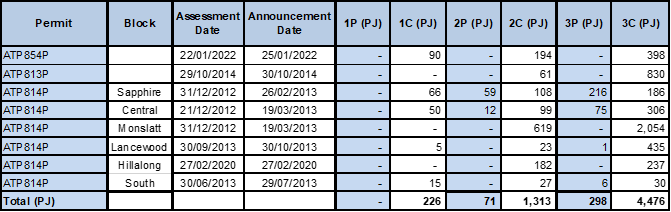

Surat Basin

- Certified 3C Contingent Gas Resource (398 PJ)

- Significant CSG development in adjacent permits

- Conventional oil and gas opportunities

| Area | 771km² |

| Holding | 100% |

| Targets | Permian Bandanna Coal Measures, Jurassic Walloon Coal Measures, Conventional Jurassic Oil (Precipice Sandstone) |

| Work Completed | Oil exploration well, CSG core hole drilling program |

| Infrastructure | Close to gas pipeline infrastructure |

RESERVES & RESOURCES

ATP854P is located near the township of Injune in central Queensland. The Wallumbilla - Gladstone gas pipeline passes through the eastern portion of the permit, and gas discovered in this block is well located to access infrastructure and move gas either through to Gladstone or in the south eastern Queensland, South Australian or Sydney gas markets.

Initial focus of exploration in this permit was on two distinct CSG opportunities, the Walloon Coal Measures which are productive to the south on the Undulla Nose and the Roma Shelf, and the Permian Baralaba Coal Measure Play, which is productive at Fairview and Spring Gully

Exploration drilling by an adjacent tenement holder (GLNG) has been conducted on the north eastern boundary of ATP854P and resulted in gas production from the Permian coals at the Spring Rock pilot wells.

NSAI reviewed this Blue Energy tenement in January 2022 and revised their estimates of recvoverable gas resources upward by 300% to 398 PJ (3C) by Blue Energy.

BASIN PARTICIPANTS

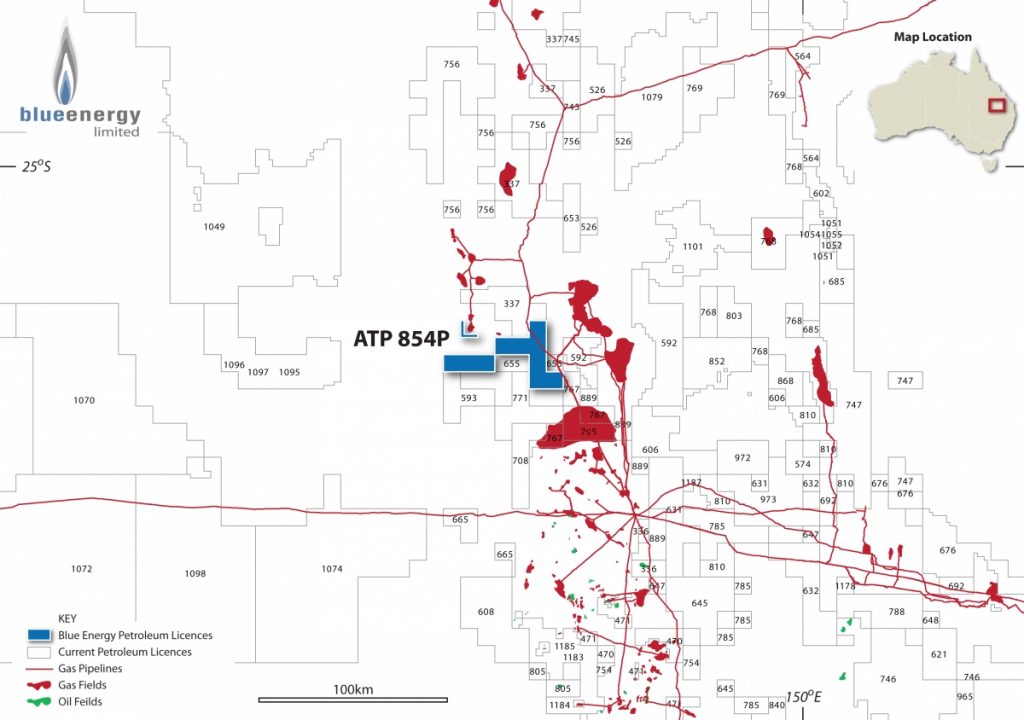

Greater McArthur Basin

- 9 contiguous blocks

- Strong oil and gas potential

- Blue Energy is Operator, controlling its future direction

| Area | 111,887km² |

| Holding | 50% (post farm in) |

| Targets | Cambrian Shale sequence, Cambrian carbonate and clastic sequences, Proterozoic section |

| Work Completed | Completed a regional gravity and aeromagnetic mapping project to understand the basin architecture |

| Infrastructure | Mereenie-Darwin Gas Pipleline, Alice Springs - Darwin Rail line |

Blue Energy reached an agreement in May 2013 with Australian Oil and Gas Pty Ltd to farm into 9 permits (3 awarded and 6 applications) in the Wiso Basin of Central Northern Territory. Under the agreement, Blue Energy becomes Operator of the permits and will conduct Geological and Geophysical Studies, acquire aeromagnetic and gravity survey data and acquire 2D seismic data.

The Wiso Basin is an essentially un-explored basin lying to the north of the Amadeus Basin, which contains the Palm Valley gas field and Mereenie gas and oil field. The surface area known to overlie the Wiso Basin is the Tanami Desert region of the Northern Territory.

Based on geological work conducted by Blue Energy to date, plus that of other Operators and the Northern Territory Department of Mines and Energy, it is clear that the Wiso Basin is in fact a part of the Greater McArthur Basin, where oil and gas discoveries have been established in recent years to the east.

Analogue basins to the Greater Macarthur Basins occure in Eastern Siberia and Oman (Middle East) which have, by contrast, been extensively drilled and very significant discoveries of oil and gas have been made from these older rocks. Reserves and production from these analogue basins are substantial.

The older geological sequences have the capacity to house supergiant oil fields and the paleogeography of the Cambrian and Proterozoic ages places these Northern Australian basins in a very attractive neighbourhood for exploration.

BASIN PARTICIPANTS

Contact.

p +61 7 3270 8800

e info@blueenergy.com.au

Level 10, 26 Wharf Street

BRISBANE QLD 4000

PO BOX 10261

BRISBANE QLD 4000