Vision Mission Strategy.

VISION

Blue Energy has a vision to become Australia’s leading mid-sized oil and gas exploration and production company and to continue to build the 3P reserve base to 3TCF.

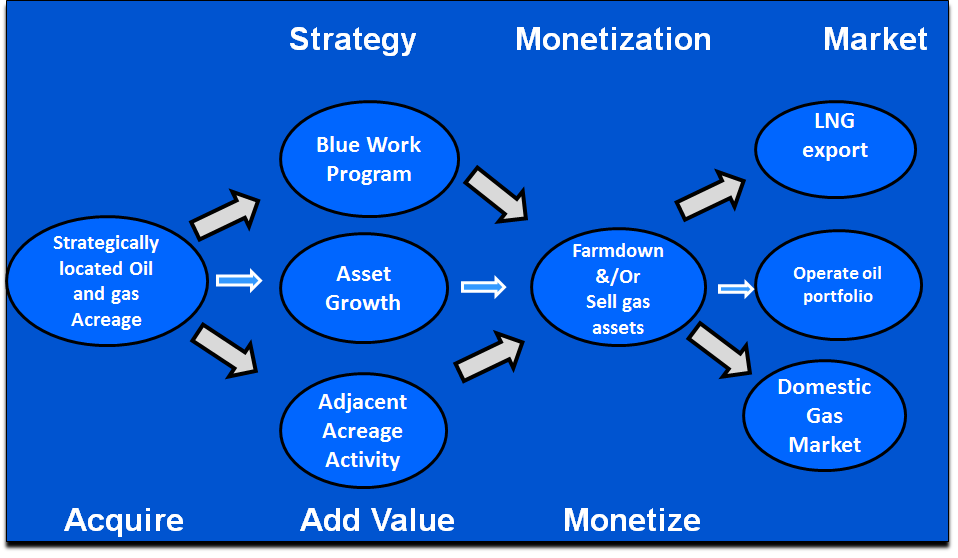

STRATEGY

Blue Energy will utilise our own work program to add value plus use adjacent competitor activity to enhance the value of Blue's portfolio wherever possible. In this way, Blue will minimise expenditure of our shareholders' funds, but maximise the benefit of competitor expenditure to Blue Energy.

COMMERCIAL OBJECTIVES

- Achieve commercial gas flow rates from its North Bowen Basin assets.

- Build Blue's 2P and 3P gas reserves and contingent gas resources base.

- Continue to undertake work on the Production Licence applications for the ATP 814 permit resource in the Bowen Basin.

- Add value to greenfield assets at the front end exploration phase

- Maintain excellent safety record

Blue Energy seeks to service both the domestic east coast gas market plus the LNG export market, where approriate.

Blue has executed Heads of Agreements (non- binding) with Origin Energy and EnergyAustralia for the supply of gas for their domestic operations, delivered to Wallumbilla, for 10 years, with total contracted volumes up to 400 PJ. These gas volumes are set to underpin a gas pipeline construction to link the North Bowen Basin with the east coast gas market at Wallumbilla. Blue has aslo executed an MoU with Queensland Pacific Metals for the supply of 112 PJ of gas over 15 years to their proposed Townsville Nickel Refinery.

These agreements account for approximately 500 PJ of Blue's aggregate 4,476 PJ of Contingent Gas Resource. The active area in Blue's portfolio is the North Bowen Basin (ATP 814P) and these contracts are set to be primarily met from gas in this permit. These current gas supply agreements leave approximately 3,000 PJ of Blue's Contingent Resource book, un-contracted, which could be used to supply the export market, given the strong demand for gas globally and the tight supply currently being experienced.

Blue's strong financial and asset positions allows the company to negotiate from a position of strength in times of tight gas supply and rising gas prices, both globally and on the east coast, and therefore maximise commercial and shareholder outcomes. Through good Corporate Governance principles, Blue Energy’s Board of Directors will concentrate on demonstrating our ability to commercialise our gas resources.